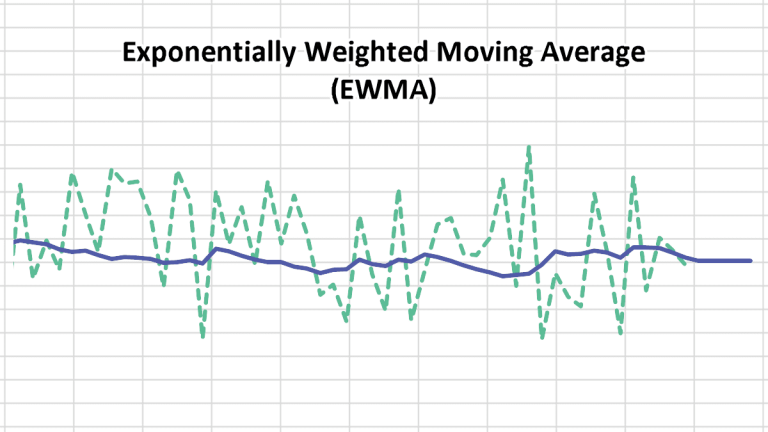

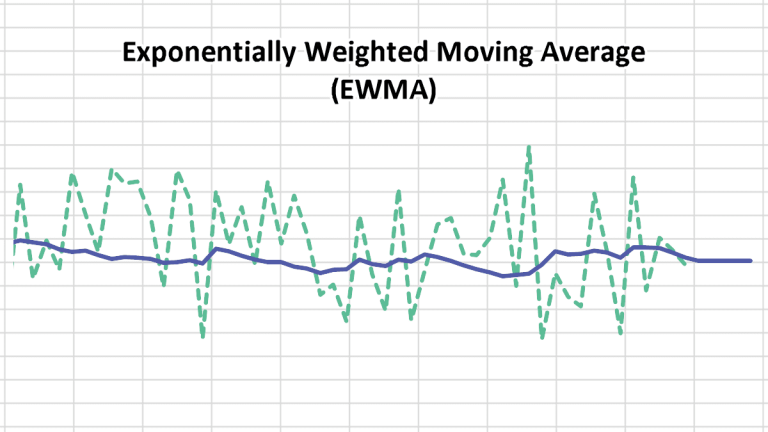

Exponentially Weighted Moving Average (EWMA)

After receiving several inquiries about the exponentially weighted moving average (EWMAi) function in NumXL, we decided to dedicate this issue to exploring this simple function in greater depth.

Home » Volatility

Read through the articles related to the volatility dynamics of financial time series data.

After receiving several inquiries about the exponentially weighted moving average (EWMAi) function in NumXL, we decided to dedicate this issue to exploring this simple function in greater depth.

This week, we’ll take the prior discussion further and develop an understanding of autoregressive conditional heteroskedasticity (ARCH) volatility modeling. Why do we care? Volatility cannot be directly

This week, we continue our on-going series on volatility modeling and forecast. In this issue, we start by defining the various terms in an asset’s

In this article, we will start with the definition and general dynamics of volatility in financial time series

This week, the “Tips & Tricks” newsletter tackles the issue of the volatility forecast using GARCH Modeling techniques. Starting with S&P 500 ETF monthly prices, the

© 2024 Spider Financial Corp | | Terms & Conditions | Disclaimer | Privacy Policy | Trademarks & Copyrights