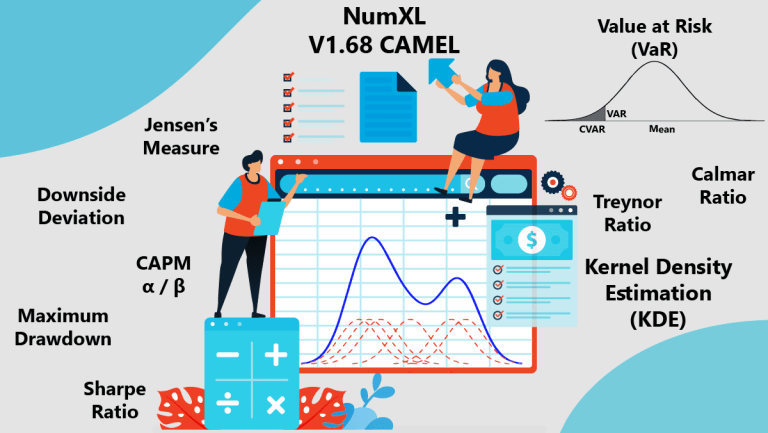

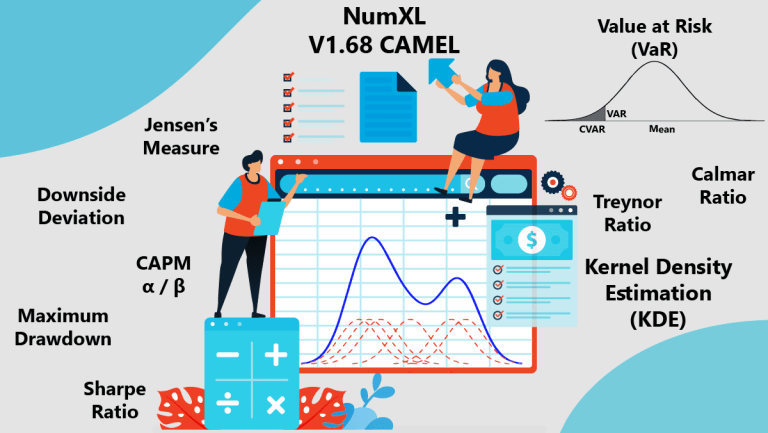

NumXL V1.68 CAMEL is Here!

NumXL Version 1.68 (CAMEL) is here! Start your free trial to get the new KDE wizard, plus 11 new portfolio risk statistics.

Home » 1.68 CAMEL

Read through the articles related to NumXL 1.68 (CAMEL) release and its features.

NumXL Version 1.68 (CAMEL) is here! Start your free trial to get the new KDE wizard, plus 11 new portfolio risk statistics.

We are thrilled to announce the launch of the beta testing phase for NumXL 1.68! The new version contains the KDE and Portfolio Analysis.

© 2024 Spider Financial Corp | | Terms & Conditions | Disclaimer | Privacy Policy | Trademarks & Copyrights